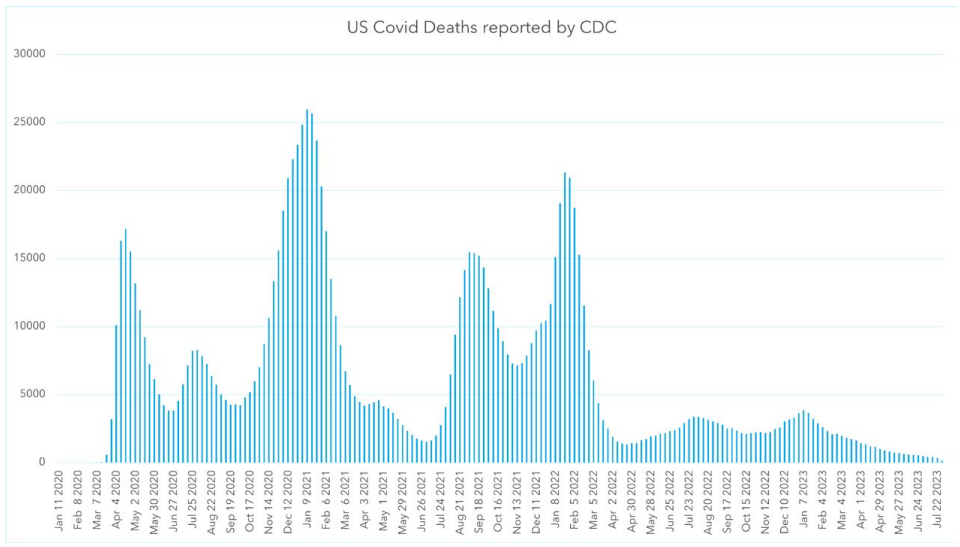

The World Health Organization (WHO) declared an end to the public health emergency due to COVID-19 on May 11th of this year. The Centers for Disease and Control (CDC) tracks all causes of death and has published provisional summary for 2022 deaths including COVID-19 related deaths. The data below highlights the sporadic increase in COVID-19 deaths during the multiple waves of the pandemic.

It remains to be seen if a new COVID-19 wave will emerge in late 2023, but all indications point to COVID now being a lower-level endemic.

Source: https://covid.cdc.gov/covid-data-tracker/#trends_weeklydeaths_select_00

COVID-19 was associated with approximately 246,000 deaths in the United States during January-December 2022. The above weekly graph from the CDC ¹ shows provisional COVID-19 deaths on a standalone basis since the start of the pandemic. It highlights five separate and distinct waves from 2020 through to end of April 2022. Since May 2022, the trend has oscillated between 1,500 and 4,000 COVID-19 deaths per week. But since the start of this year, 2023 has been trending towards zero.

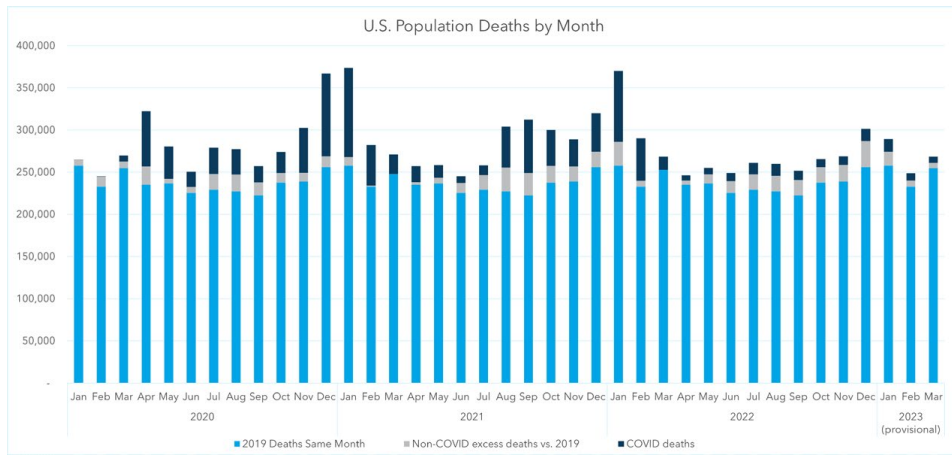

The methodology for analyzing the impact of COVID-19 for this report is using a simplified approach of comparing the actual death counts for each month of the pandemic vs. same month in 2019, prior to the pandemic. Note: this is not an actual to expected analysis, as there is no mortality table assumption involved; subsequent reports in this series will have Actual to Expected analyses. This analysis is trying to identify the excess mortality assuming similar mortality trends extending from 2019 into future years.

The graph below highlights the higher winter deaths and lower summer deaths in the light blue color, which has been evident for decades in population data. This phenomenon accounts for roughly a 7-10% increase in winter deaths vs. summer deaths and was evident in all 3 datasets. COVID-19 had waves that occurred in all seasons, coming and going for different lengths in different time periods across various quarters. Therefore, analyzing monthly instead of quarterly or annual allows for a better focused analysis of the true excess mortality due to COVID-19 within each wave. Monthly comparisons allow for a lateral comparison neutralizing seasonal impacts of mortality.

Source: https://covid.cdc.gov/covid-data-tracker/#trends_weeklydeaths_select_00

The non-COVID excess deaths in 2022 shown above in gray are running 7% higher than 2019 pre-pandemic levels. This is being driven by higher heart disease, diabetes-related diseases, and accidents such as suicide and overdose. These appear to be indirect, secondary impacts relating to the pandemic and downstream effects of lost wages and loneliness which were more impactful on the lower end of the economic demographics. This highlights the incremental impact of both official COVID-19 recorded deaths and other excess deaths which may or may not be due to secondary impacts of COVID-19.

The question remains, how many (if any) of these secondary impacts will migrate up the economic ladder into the life settlement risk pool?

Life Settlement Mortality

Using the CDC Wonder database is great for monitoring population mortality. The life insurance subset is generally a higher economic demographic subset with longer than average life expectancies (We will explore this effect more in a future report).

The life settlement pool is a subset of life insurance pool, and the ‘standard’ life expectancy is even longer. Hence one might expect the effect of COVID-19 to follow similar patterns. Let’s dig into our Longevity mortality datasets to see what extent COVID-19 impacted similar and different as compared to population mortality.

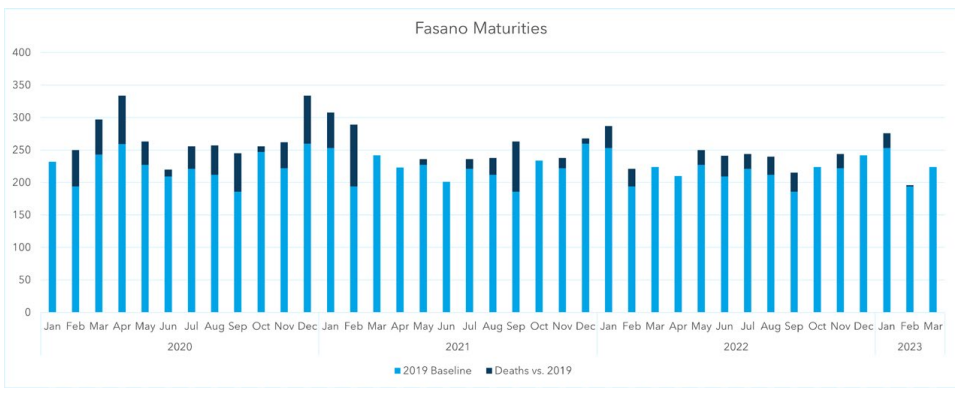

The below graph takes data that was created from the Fasano life settlement underwritings for the Life Expectancy (LE) product, covering over 65,000 lives underwritten by Fasano during the past 22 years.

Deaths are plotted by month and compared to the same number of deaths in 2019, the year prior to COVID-19, as a baseline. Significant excess deaths are assumed to be due to COVID-19. The data shows significant spikes in mortality during the 1st and 2nd waves of COVID-19, and one significant month of excess deaths during the early stages of the Omicron wave. September of 2021 had the largest month of increased deaths; +49% vs. 2019 same month.

Source: https://www.cdc.gov/nchs/nvss/vsrr/COVID19/index.htm as of 8/2023

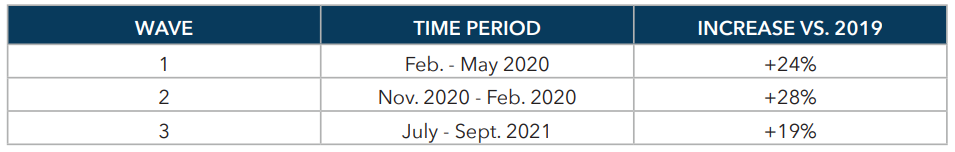

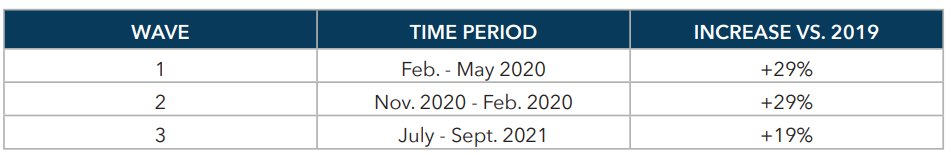

A summary of relative impact for each wave of the COVID-19 pandemic range from 20-30% in line with the population COVID-19 increases.

Additional deaths from October 2021 forward can be attributable to the aging of the dataset.

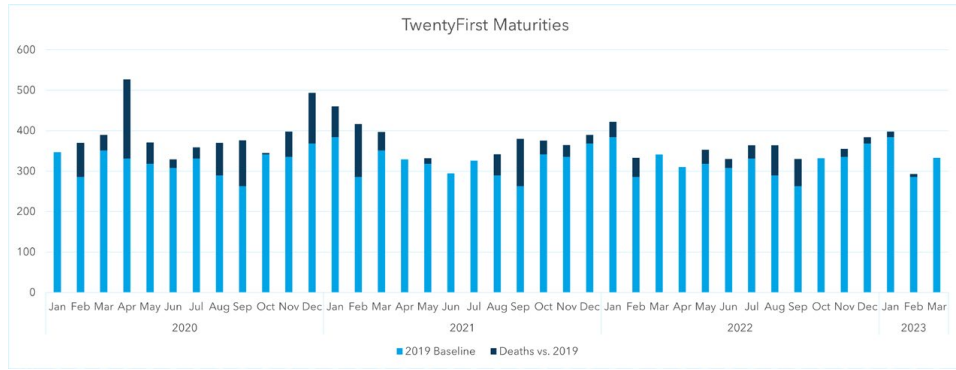

The below graph takes data that was created from the TwentyFirst underwritings for the Life Expectancy (LE) product, covering over 98,000 lives underwritten by TwentyFirst during the past 20 years.

The actual life settlement deaths in the 21st underwriting dataset do not indicate any recent excess in the past 20 months compared to the first year of the COVID-19 pandemic. The pronounced spikes in March 2020 and winter of 2020/21 highlight COVID-19’s impact during the first two waves of the pandemic.

A summary of relative impact for each wave of the COVID-19 pandemic range from 20-30% in line with the population COVID-19 increases.

Similarly, the additional deaths from October 2021 forward can be attributable to the aging of the dataset.

Conclusion

Excess mortality due to COVID-19 hit the life settlement industry by the same scale as the population excess mortality for the early stages of the pandemic. By the end of 2021, the excess mortality effect has mostly subsided versus excess mortality persisted for the population well into 2023.

Based upon the review of COVID-19 mortality since inception of the pandemic to present day, it has been determined to not make assumption changes to the base mortality tables for our LE businesses due to COVID-19. Small debit adjustments have been made to account for long-COVID and other active COVID-19 conditions on a case-by-case basis.

John Lynch is Director of Actuarial & Underwriting Services at Longevity Holdings

Any views expressed in this article are those of the author(s) and do not necessarily reflect the views of Life Risk News or its publisher, the European Life Settlement Association