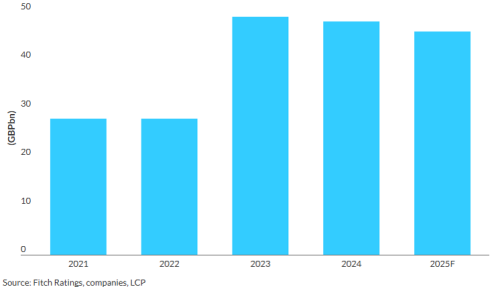

UK life insurers are poised to continue benefitting from strong bulk annuity volumes in 2025 despite potential challenges from regulatory changes, Fitch Ratings says. Fitch expects transactions to surpass £40 billion for the third consecutive year, supported by favourable market dynamics and substantial capital inflows.

The UK government’s plan to allow well-funded pension schemes to release surpluses to sponsoring employers may weaken bulk annuity pipelines in the short term, but we still expect strong demand from sponsors looking to transfer pension liabilities to insurers to reduce their balance-sheet risk. The life sector has good capacity to meet the demand due to strong capital and several recent new entrants, drawn by the predictable long-term profitability of bulk annuities.

Bulk Annuity Volumes

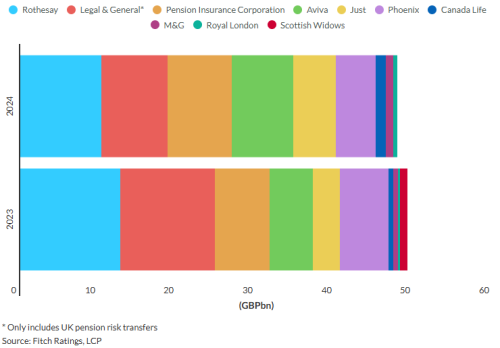

Bulk Annuity New Business Premiums

The bulk annuity market has high barriers to entry. Firms require significant long-term capital and specialist expertise, including asset sourcing, actuarial modelling and risk management, and regulatory approval is not straightforward. However, there have been several new entrants recently, with Royal London and Utmost entering the market in 2024 and Blumont Annuity joining this year. These insurers are bringing substantial capital and asset-sourcing capabilities to the market and helping to revitalise deal activity from smaller pension schemes. Meanwhile, more established insurers have implemented price monitoring and streamlined solutions to serve the small scheme market, while those with robust excess capital continue to pursue larger deals.

An increasing number of new and established reinsurers are showing interest in the UK bulk annuity market. Notably, InEvo Re, a reinsurer established by Macquarie Asset Management, announced its first reinsurance transaction with a UK life insurer in 1Q25. We expect continued use of funded reinsurance to support large bulk annuity transactions despite fairly muted market activity in late 2024 due to tighter regulations. However, we do not expect the use of funded reinsurance to exceed 30% of bulk annuity premiums, and insurers are likely to limit their exposure to individual credit-focused reinsurers and the associated concentration risks. The Prudential Regulation Authority’s (PRA) upcoming life insurance stress test (LIST 2025) will provide additional insights into bulk annuity providers’ vulnerabilities and resilience.

Bulk annuity insurers’ demand for long-term illiquid assets continues to rise, and their increasing exposure to illiquid and private assets, including private credit, is a key focus for Fitch. Exposure to private credit may involve additional risks, particularly due to lack of transparency. However, Fitch expects insurers to limit their exposure and maintain well-diversified asset portfolios, in line with their generally prudent risk appetites and due to regulatory scrutiny.

The PRA’s recent proposal to remove the requirement for insurers to obtain regulatory approval before claiming ‘matching adjustment’ benefit on certain assets could make it easier for insurers to take advantage of investment opportunities more quickly. The matching adjustment allows insurers to take credit for the illiquidity premium earned on certain assets that will be held to maturity by factoring it into the discount rate for their annuity liabilities.

The proposal, if adopted, may lead to higher investment risk due to the increased flexibility that insurers would have when making investment decisions. However, we do not expect a significant shift in insurers’ investment risk appetite as the regulator would require firms to have contingency plans for assets that do not receive subsequent approval for matching adjustment eligibility, and it would still expect them to adhere to the ‘prudent person’ principle in making investment decisions.

Rishikesh Sivakumar, CFA is Director, Insurance at Fitch Ratings

Any views expressed in this article are those of the author(s) and may not necessarily represent those of Life Risk News or its publisher, the European Life Settlement Association