The 2025 edition of the Life Insurance Fact Book – the American Council of Life Insurers’ (ACLI) annual review into the inner workings of US-based life insurance company balance sheets – was published in early November. As with previous years, I will be highlighting some notable and interesting takeaways from the Fact Book for a series of articles for Longevity and Mortality Investor, starting with this one, a review of key statistics for the US life insurance industry in general and some that have relevance for the life settlement industry in particular.

General Industry Performance in 2024

The number of life insurers continued its decline from 719 in 2023 to 711 in 2024 as further consolidation to streamline costs and, for mutuals, demutualisation continues to be popular so that additional capital can be accessed. The rise in foreign ownership continued, as the number of entities with overseas ownership grew from 101 to 109, or 15.3% of the total. Within that, Bermuda contributed a further 8 compared to 2023 – up to 30 now – and Japan is up 5 to 20. The biggest reduction was from the UK, down from 7 insurers to just 2 in 2024.

Total assets of life insurers rose from $8.74trn to $9.26trn (+5.9%) in another strong year for the industry, and total liabilities rose from $8.23trn to $8.73trn (+6.1%), which was notably more than the expansion of assets.

This shortfall in growth between assets and liabilities unsurprisingly led to a drop in Capital Ratios (CR), which measure straight surplus. The CR – including the asset valuation reserve (AVR, a reserve to smooth changes in asset prices), changed from 10.7% to 10.5% and, excluding the AVR, from 9.0% to 8.7%. Whilst these are drops, they should not be regarded as worrisome as they are simply reversals of the improvements seen last year.

The AVR rose 4.8% in 2024 to an aggregate $104bn whilst its sibling, the IMR (Interest Maintenance Reserve, which covers fixed income investments) shrunk 36.2% to $10bn as bond yields normalised during the year.

Life Insurance Products

For life insurance products, the picture was a mixed bag, with further increasing average face values of new policies offsetting stagnant sales figures. In addition, we saw a return to growth in individual policy sales and a reduction in group sales, which is a reversal of the unusual spike in group sales seen in 2023 (that arose from changes in reinsurance cession). This may have been an indication that pressure on household finances eased as inflation abated, but there were still heightened levels of policy surrenders and lapses.

Individual policy in-force face amounts were $14.07trn at the year-end, marginally up from $13.98 trn (+0.7%) with the smaller amount of group policy face falling 3.1% from $8.10trn to $7.85trn. In total, all life policy in-force face changed from $22.15trn to $22.01trn (-0.7%).

Despite the fall in overall policy face amount, policy reserves all rose. For individual policies, reserves rose 4.0% from $1.656trn to $1.722trn, and group business reserves changed from $0.194trn to $0.203trn (+4.8%).

Premium income on life products was much stronger, increasing from $122bn to $173bn (+42.2%) but this was a reversal from 2023’s equivalent, likely as a result of a reversion to normal reinsurance patterns.

Claims paid in individual contracts rose over the year in aggregate. Contractual payments from death claims were slightly down from $66.3bn to $66.2bn (-0.2%) but surrender payments rose from $35.8bn to $44.2bn (+23.7%). Although a much smaller group by value, surrenders on group policies fell from $5.8bn to $2.7bn, a fall of 52.8%. As we have seen with new sales and premium payments, 2023 seems to have been an outlier; surrenders on group policies over both 2023 and 2024 rose from $1.1bn to $2.7bn, a significant rise, and for individual policies over the same period, the figures also show a large rise, from $28.8bn to $44.2bn.

It would appear that this increase in surrender values paid out mostly arises from holders of policies with higher encashment values choosing to surrender. Although lapse rates are still above 2022 values, over 2024 they have reduced compared to 2023. Individual policy lapse rates in 2023 fell from 7.3% to 6.6% whilst those for group contracts rose only marginally from 3.8% to 4.0%. The equivalent surrender rate for individual policies is 1.3%, up from 1.2%, whilst group surrenders are in rounding error territory, seemingly unchanged at 0.1%.

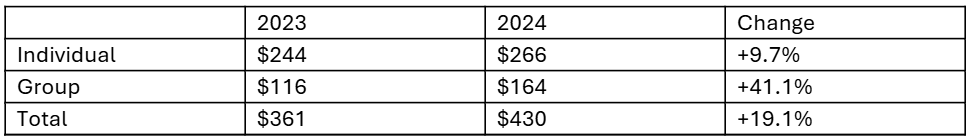

New business excluding a small amount of credit insurance was a much more mixed picture. New life products issued by face and number are shown in Figure 1 below.

Figure 1: US Life Insurance New Product Issuance, 2023-2024, $trns

Source: ACLI Life Insurers Fact Book, 2025 Edition. Totals include credit insurance

We will look at these various figures in more detail in further editions of Longevity and Mortality Investor. However, the immediate takeaway is that 2024 was a year of recovery after a difficult 2023 for households financially as inflation spiked before ebbing away. Looking at individual years can be misleading, and policyholder behaviour does not conveniently sit within calendar year conventions, so whilst new policy sales are not yet up to full strength and cancellation rates appear to have been above trend, the pattern within the year may have been more favourable towards the end.

Last year, we looked at the rise in death benefits paid out and also at how the “Covid curve” was developing. The ACLI’s published US mortality data is one additional year out of date than the life insurer data, so is not particularly meaningful to industry professionals who are much closer to current developments. All this data does is to confirm that their observations are as we know: 2020 and 2021 experienced the main heightening of mortality, and that subsequently, mortality rates were slow to return to 2019 levels and beyond (Figure 2). We don’t intend to look at this again in future.

Figure 2: US Crude Death Rate per 1,000 Americans

Source: ACLI Life Insurers Fact Book, 2025 Edition

Annuity Business

Finally, a shorter summary of the figures for annuities. Annuities represent approximately two thirds of life insurers’ reserves and so remain important.

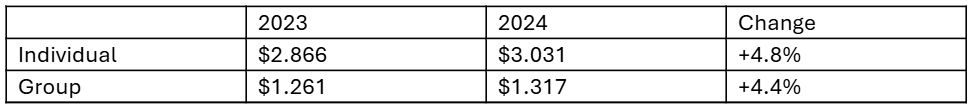

Figure 3: US Life Insurance Company Net New Contributions, $bns:

Source: ACLI Life Insurers Fact Book, 2025 Edition

Figure 4: US Life Insurance Company Annuity Reserves, $trns:

Source: ACLI Life Insurers Fact Book, 2025 Edition

In 2023, we saw an unusual rise in individual annuities and a shrinkage in group, suggesting some transfers out to individual policies, but in the main it was due to variances in the amounts of reinsurance coverage being used by some insurers, something that has not been so pronounced in 2024.

However, taken as a whole we can see a significant continued growth with net new considerations equivalent to 10% of net reserves. The reserves themselves may have reduced to a small degree as a result of risk-free yields having risen during the year, but this still suggests activity remained robust in this business sector relative to historic levels.

Conclusion

As with previous years, the US life insurance industry had a solid 2024 from a balance sheet perspective and continues to be healthy from a risk perspective. Whilst liability growth outpaced asset growth last year, the difference was minimal, and the legacy of the Covid-19 pandemic still appears to be diminishing, to the point where, as I mentioned previously, unless something extraordinary happens, it will not be considered for this article next year.

Whilst capital ratios also retreated slightly, this appears to be more of a reversion to the norm as opposed to anything particularly concerning, so institutional investors with alternative investments that carry exposure to US life insurers – life settlements, life ILS, life-contingent structured settlements, for example – remain connected to an industry that was, as of the end of 2024, in good health.

Roger Lawrence is Managing Director at W L Consulting

Any views expressed in this article are those of the author(s) and may not necessarily represent those of Longevity & Mortality Investor or its publisher, the European Life Settlement Association