The third of our reviews of the ACLI digest of US Life Insurance statistics focusses on how factors affecting the life settlement market are developing. Key amongst these are the surrender volumes, which help indicate the volumes of policies that could be available to trade, and the rate of new business.

The ACLI data are all retrospective and the latest set refers to the year 2022 which, by now, is already just over a year old compared to market participants’ current experience; it is also information of a low granularity, so one needs to be aware that there are some generalisations being used to imply trends. The types of policy most commonly traded in the secondary market are only a sub-set of the whole range of life insurance products issued, so a trend in total business may not perfectly reflect the trend in tradeable products alone.

Policy Cancellations

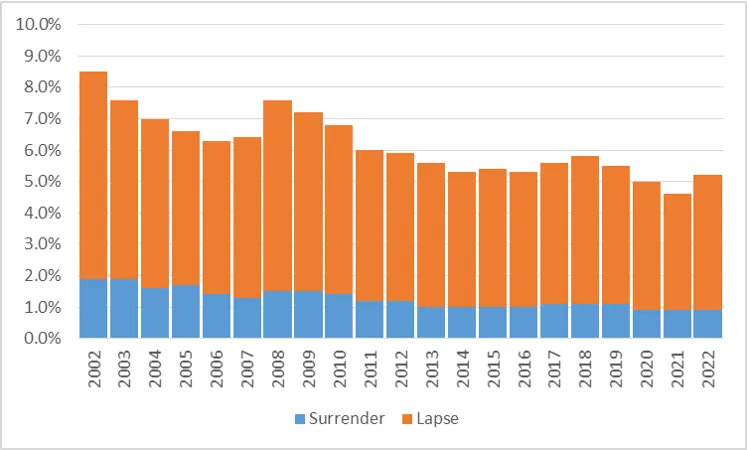

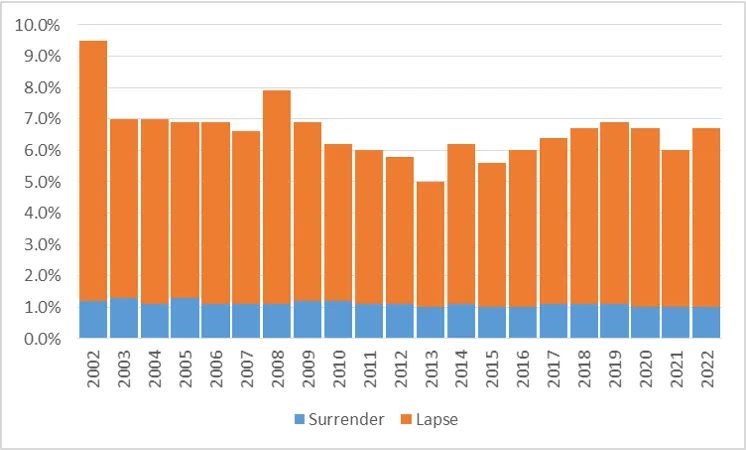

Policy exits will come about as death or maturity claims and, possibly most commonly, through lapse (with no value) or surrender (if there is an intrinsic value), although the two may be aggregated in some statistics. The ACLI provide cancellation rates split by surrender and lapse and split the figures between individual and group policies. We will focus on individual policies, as shown in Figures 1 and 2 below, but there is no further granularity between product types.

Figure 1: Individual Policy Cancellations by Face Amount

Source: ACLI Life Insurers Fact Book, 2023 Edition

Figure 2: Individual Policy Cancellations by Number

Source: ACLI Life Insurers Fact Book, 2023 Edition

Over the twenty years from 2002-22, cancellation rates have been slowly reducing; that applies to surrender rates as well as lapse rates, and by both policy numbers and by face amount. Periods of financial stress, notably 2008 and 2009, affected cancellation rates as one would intuitively expect. 2022 saw an uptick in total cancellations from 2021 as higher interest rates and inflationary effects on consumer budgets started to bite; it’s not unlikely that this may have continued into 2023 and 2024.

Lapse rates will include all term policy cancellations and a proportion of universal Whole of Life (WOL) policies that have been allowed to lapse after draining any built-up policy value. Surrenders will primarily be WOL and Endowment policies that are simply cancelled on the spot whilst the policy still has a positive value, probably because there is no longer a need for life cover, settling a divorce, or for capital raising reasons, rather than allowing the policy to dwindle away by running down policy value.

The 2022 total cancellation rate was 6.7% (lapse 5.7%; surrender 1.0%) by policy number but only 5.2% (lapse 4.3%: surrender 0.9%) by face amount. That pattern applies to all historic years and again is to be expected as it tells us that on the whole it is the small face policies that are most frequently cancelled early, and it is likely that these are held by people more susceptible to a personal financial shock.

From all of these values, the most interesting ones for the life settlement market are the rates of cancellation of WOL policies, although some other policy types are traded. Unfortunately, there are no more granular figures available to specifically extract such values. We can fairly reasonably assume the vast bulk of the surrenders relate to WOL policies and together with a smaller proportion of the lapses. The surrender rates themselves are an aggregate figure for all policy types, so the rate that applies to just a population of WOL policies in force will be greater. By how much is not possible to tell, but it is at least twice the stated rate for surrenders judging by the relative levels of new policy sales between the two product groupings (reviewed below).

Whilst the absolute values for cancellation rates of WOL policies are important to the life settlement secondary market, so too are the relative patterns on a year-by-year basis. This is remaining stable, albeit with the emergence of a slight bulge in 2022, and one would expect this to continue whilst higher interest rate conditions prevail. Regulatory pressure on insurers to increase persistency, and to reduce potentially unwanted product sales, will be forces pushing back against the life settlement market, but there is a limit to how far this can go as there will always be a need for some policyholders to cancel early.

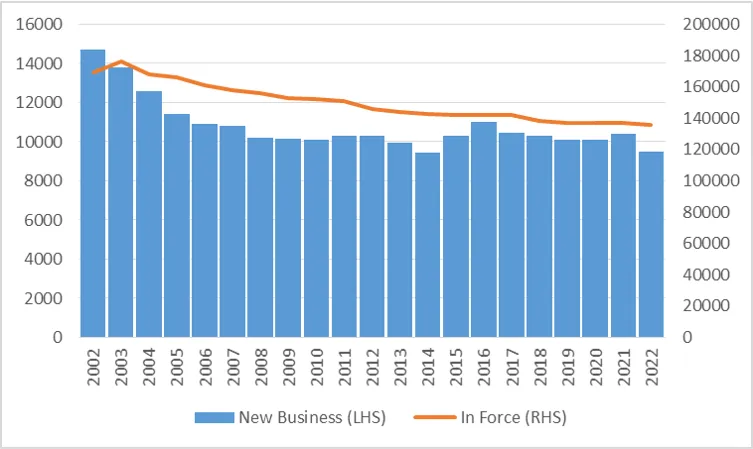

New Policy Sales and In Force Life Insurance

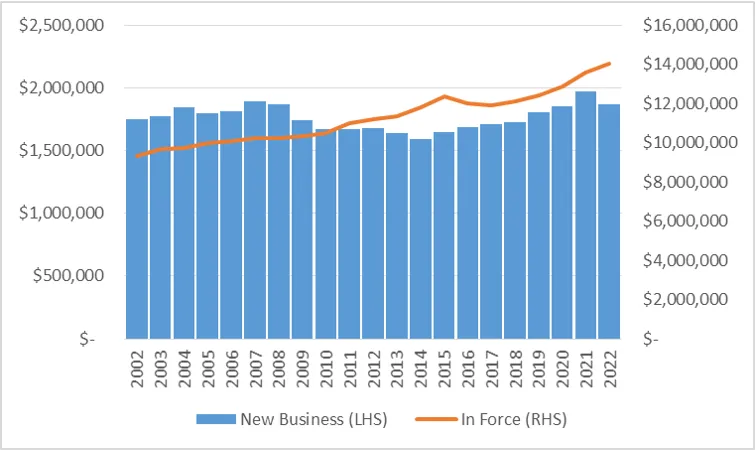

These values are of interest to the life settlement investor because they represent the reservoir of future tradeable product and the rate at which the stock is being built up or replenished as other policies drop away as lapses, surrenders, or claims. Both Numbers and Aggregate Face Amounts are provided in Figures 3 and 4 below. In our analysis, we have concentrated on individual policies, although there is also a substantial number of group certificates as well; these, however, are typically much smaller in value and have been excluded.

Figure 3: Individual Life Insurance Policies, New Business and In Force, by Number

Source: ACLI Life Insurers Fact Book, 2023 Edition

Figure 4: Life insurance Policies, New Business and In Force, in Aggregate

Source: ACLI Life Insurers Fact Book, 2023 Edition

The aggregate in force face amount has steadily increased and is now $14.02trn. The rise in this value represents an annual growth rate of 2.1%pa which, when compared to the growth rate of US GDP over the period of 4.3%pa, represents a slow decline in value in real terms.

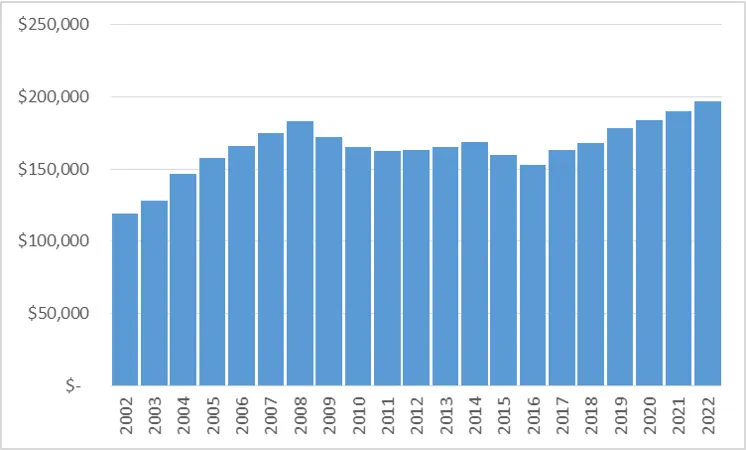

By policy number, the trend has been for slowly reducing volumes of sales although the rate of decline has reduced in recent years. Measured by face amount, new business levels are broadly flat throughout the period. This contrasts with a decline by numbers, suggesting that larger policy sizes are compensating for reducing volumes as can be seen in Figure 5 below.

Figure 5: US Life Insurance New Business, 2002 – 2022, Annually by Average Face Amount

Source: ACLI Life Insurers Fact Book, 2023 Edition

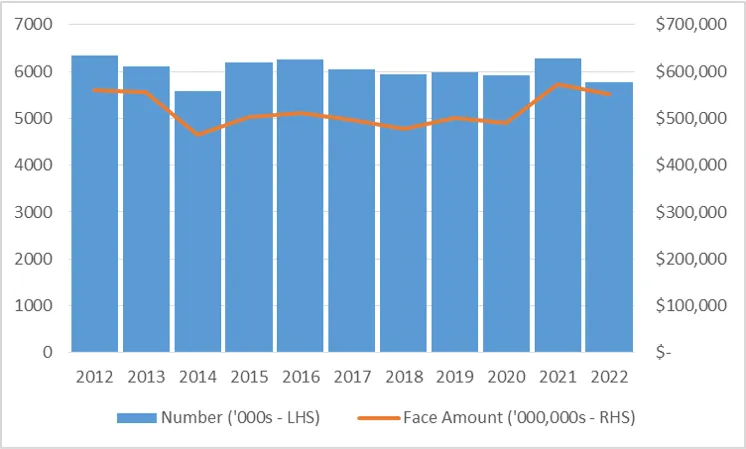

Whole of Life and Endowments Specifically

The aggregates for individual policies refer to all business, including term policies of differing types. These polices make up roughly half of the total new business and typically carry larger face amounts than whole of life or endowment policies. The data available aggregates WOL and Endowment although sales of the latter are a relatively small proportion.

Figure 6: US Life Insurance, Individual WOL and Endowment New Business, 2012 – 2022

Source: ACLI Life Insurers Fact Book, 2023 Edition

A historic dataset is not available so we can only show data back a decade, but the pattern is one that is fairly stable both in number and size. For policy traders, that is superficially good news, but the picture is slightly coloured by the fact that whilst nominal aggregate face amounts have remained stable, in real terms they will have been declining.

Summary

Policy cancellation rates are currently being driven by economic conditions, but the broad trend is one of slowly reducing rates of policy lapse or surrender. By and large, however, they remain stable.

New business remains buoyant which bodes well for the near- and medium-term future, but replacement rate both in terms of numbers and policy size (in real terms) is still in a phase of slow decline. This may be due to a general trend towards a reducing household savings ratio across the US rather than any fiscal or regulatory changes that make products relatively unappealing compared to alternatives. At the present rate of decline, one would conclude that there remains plenty of longevity in the secondary policy market yet.

Roger Lawrence is Managing Director at WL Consulting

Any views expressed in this article are those of the author(s) and do not necessarily reflect the views of Life Risk News or its publisher, the European Life Settlement Association