Data and analytics firm PitchBook published its full year 2023 report on the insurtech industry in early March, showing that activity from the venture capital funds in the space delivered a six-year low in both the number of deals completed (486) and the aggregate value of deals ($5.6bn).

The data wasn’t surprising to many industry observers: the private markets experienced fundraising and dealmaking challenges last year as macroeconomic (rising interest rates) and microeconomic (the fallout from the collapse of Silicon Valley Bank in March) forces conspired to put the brakes on the extraordinary recent growth rate in the space.

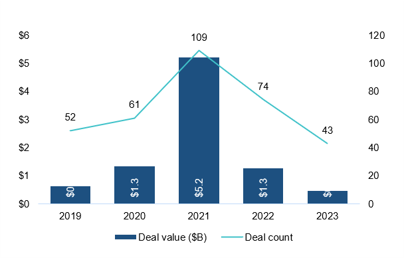

The overall trend is mirrored in the life and health segment of the insurtech market that PitchBook tracks. As can be seen from Figure 1 below, activity in the segment fell by approximately one half based on deal count, and a third ($0.5bn) based on aggregate deal value.

Figure 1: Global VC deal activity in the Insurtech health & life segment

Source: PitchBook Data, Inc

The apparent precipitous decline in activity in the market from the halcyon days of 2021, however, shouldn’t be cause for concern.

“Over the past couple of years, private market valuations for insurtech companies were considered overpriced, but public valuations may have begun to bottom out in late 2022, as reflected in the HSCM Public InsurTech Index. The index declined by over 70% as of year-end 2022 from a high in early 2021. However, the index has partially recovered and was up 32.6% in 2023,” says Robert Le, Senior Analyst, Emerging Technology at PitchBook, in the report.

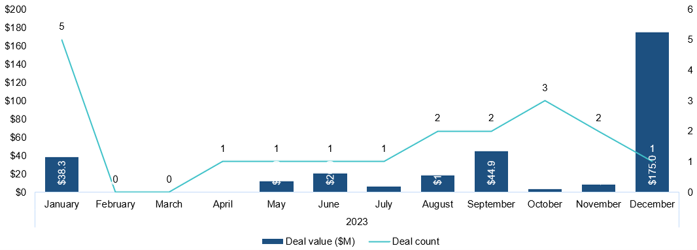

Perhaps unsurprisingly, activity in the life and health segment of the insurtech market is more robust in North America than in Europe or Asia. In 2023, 19 deals were completed worth $326.5m, with just one of these, Devoted Health’s Series E round, accounting for $175m of that in December.

Figure 2: North America VC deal activity in the Insurtech health & life segment

Source: PitchBook Data, Inc

That compares handsomely with Europe ($28.4m across 11 deals) and Asia ($98.4m across six deals). The reasons for the difference are not so much idiosyncratic to the insurance space as they are a mirror of the venture capital market more broadly.

“The insurance market in the US may be regulated at the state level, but it’s still much more homogenised than it is in Europe, where you have different languages, cultures, and just as importantly for the insurance market, significant divergence in the regulatory landscape. Most insurtech innovation to date has been in the US,” says Brian Casey, Partner and Co-Leader of the Regulatory and Transactional Insurance Practice Group at Locke Lord.

One point of note for life risk investors – both public ones that access life insurance companies through the public equity or liquid debt capital markets, and private ones that own or have an equity stake in life insurers – is that the PitchBook report contains a mention of the annuities market. According to the report, it’s one that is ripe for disruption.

“Although the annuities industry is one area that has seen little insurtech innovation, that is beginning to change… large insurers face mounting challenges, including legacy processes for distributing annuity products and managing the relationship between policyholders and insurers,” says Le in the report.

At the end of January, a press release from the Life Insurance Marketing and Research Association (LIMRA) says that annuities sales increased for the second consecutive year, to a record $385bn. Not all of those will be lifetime annuities (the type of annuity which contains longevity risk) but still, the growth of the overall market in the US shows the opportunity for insurtechs looking to disrupt the space.

The outlook for the insurtech market generally going forward remains uncertain. At a general level, PitchBook’s report refers to the impact of climate change on the industry in terms of insurers withdrawing from certain regions, insurance premiums increasing, and a hardening reinsurance market.

More specifically for the life insurance space, there is increasing uncertainty around mortality data; life expectancy at birth in the US decreased in 2021 for the second consecutive year, for example.

How this translates to venture capital funds putting dollars into insurtechs remains to be seen. Many factors that aren’t directly related to the insurance sector influence the flow of capital, ranging from macroeconomic to a generally tighter approach to investing across the entire VC industry. For Casey, however, there is room for optimism.

“The insurtech market is moving through its natural lifecycle as we have seen more M&A transactions involving insurtechs as well as right-sizing for those that have not yet been able to achieve expected performance. If the public insurtechs can start delivering better financial results, then VC capital will take notice of that,” said Casey.