In early November last year, industry group the American Council of Life Insurers (ACLI) published its annual Life Insurers Fact Book, the organisation’s deep dive into a range of sub-categories of the US life insurance industry. In December, we looked at 2024’s developments in surrenders, new business and solvency; this month, as was the case last year, we’re taking a look at the US life insurance market as a whole: Its ownership, business composition, and size.

Ownership Trends

Last year’s report once again shows a continuing decline in numbers of individual life insurance issuing entities, from 719 in 2023 to 711 in 20241 – and a 47% reduction since 20012. The change continues to be gradual but cost pressures and regulatory overhead means smaller firms find their operating environment increasingly challenging. With their limited potential consumer base, it is to be expected that Fraternal insurers would be under pressure but it is notable that their decline is marginally smaller than full stock companies, from 117 in 2001 to 65 in 2024 (-44%) for the Fraternals, and 986 in 2001 to 530 for the full-stock firms (in the UK, the equivalent are either Friendly Societies or Occupation-based insurers, such as teachers or post office workers, and these have all but been swallowed up by larger firms, or mutuals).

It is easy to point the finger at regulatory creep for causing consolidation, and there has also been a steady drift towards using offshore havens for domicile (Figure 2). Bermuda has become the location of choice, more than doubling in just five years from 14 to 30,3 because the regulatory approach is sufficiently robust to maintain confidence of domestic regulators, albeit, under a close watching brief. Much of the increasing Bermudan influence is from alternative asset managers using their reinsurers to access the primary market.

Canadian ownership is stable but for other countries there are some notable changes with Japanese ownership rising (from 16 in 2020 to 20 in 2024) and UK and Netherlands ownership falling.

Business Composition

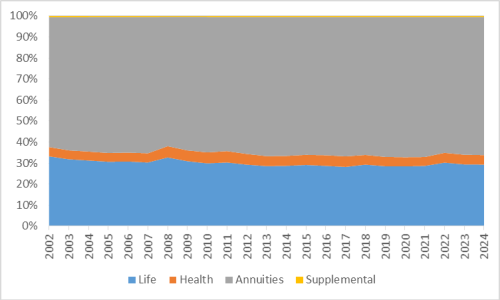

In 2024 total liabilities rose 6.1%, life insurance policy reserves grew by 4.1%, health insurance by just 0.67% and annuities grew by 4.7%. Each of the growth rates for specific product groups’ reserves are lower than the figure for companies as a whole and the biggest contributor to the excess is a small subdivision pertaining to deposit-type contracts. Here, liabilities rose 10.7%.

This group of products is significant in as much as they represent more than 10% of total policy reserves and are comprised of Guaranteed Investment Contracts (GICs), annuities certain, structured settlements and premium and other deposit type funds. In 2024, premium and other deposit funds remained the largest category of the deposit-type business with $267bn in deposits, $265bn in payments, and $358bn in reserves at year-end. GICs received $143bn from policyholders and paid out $103bn in 2024, leaving a reserve of $352bn at year’s end.

For basic product types, annuities still dominate, but life insurance is now growing at a similar rate to annuities which is promising for the future of secondary markets.

Figure 1a: Composition of US Life Insurance (by value of policy liabilities) 2003-2024

Source: ACLI Life Insurers Fact Book, 2025 Edition

The chart above shows that annuities continue to represent the lion’s share of policy liabilities and, even if there were no further sales, this would persist for many years. However, whilst annuities rose from 62% of the mix in 2002 to 67% by 2021, in recent years this has flattened out. In fact, in 2022 onwards there has been a drop of approximately 1% – this looks like a technical change when interest rates and bond yields started to rise in 2022 (we are measuring relative size by liabilities here, so rising bond yields would be expected to lower annuity liabilities, especially those of a fixed nature rather than index-linked in some way.

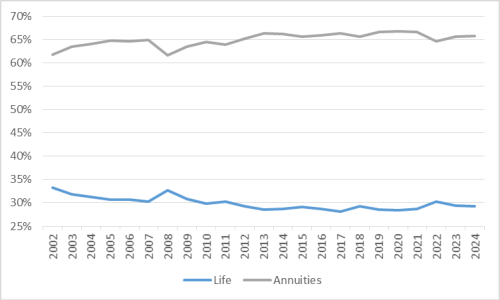

Showing just annuities and life, the picture is clearer as can be seen in Figure 1b below.

Figure 1b: Composition of US Life Insurance (by value of policy liabilities) 2003-2024 (Life and Annuity only)

Source: ACLI Life Insurers Fact Book, 2025 Edition

US Life Insurance Market Size (by Liabilities)

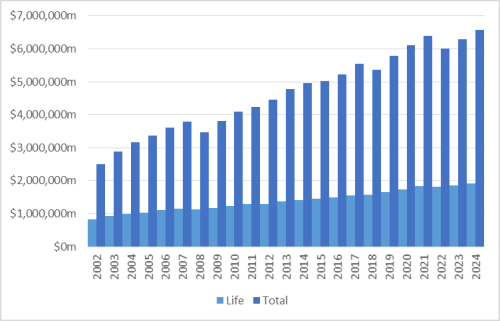

An updated figure 2 below gives greater clarity in monetary terms. In 2022 policy liabilities fell, largely because of a rise in bond yields increasing valuation discount rates. The step-up in 2023 and 2024 from 2022 in the total liabilities looks very similar to the step-up between 2020 and 2021 arising from additional business rather than a change in valuation discount rate as discussed above.

Figure 2: Insurance Liabilities 2002 to 2024

Source: ACLI Life Insurers Fact Book, 2025 Edition

You can also see that the growth in reserves for the life insurance component alone had tailed off in 2023 but has once again started rising in 2024. Part of this is the technical effect described above, whereby higher discount rates suppressed reserve growth in 2022, but we can also see that they have now grown in 2024 compared to 2023. This is clear from the rise in life policy liabilities from 1.7% in 2023 to 4.1% in 2024.

This does look like a return to trend with the hiatus in 2023 being down to a modest rate of new policy sales in 2023 and, in particular, a very high rate of cancellation.

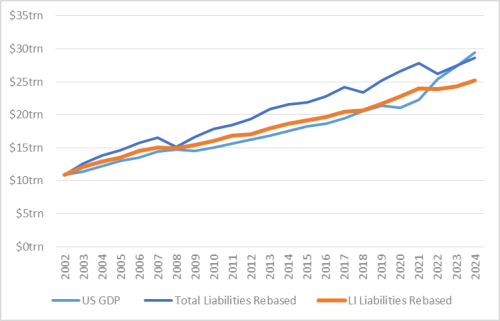

Comparing the insurance liability totals with US GDP, we continue to see a strong correlation, as shown in Figure 3 below.

Figure 3: Total Insurance Liabilities (rebased 2002) and US GDP (2002 to 2024)

Source: ACLI Life Insurers Fact Book, 2025 Edition

Figure 3 tells whether insurance products are diminishing in importance within the US relative to total GDP. The orange line shows just life insurance products whereas the dark blue line includes annuities. US GDP has been on a noticeable expansion trajectory since the Covid-19 blip and life insurance products alone do appear to be slowly falling out of fashion. This might be just a cyclical effect, or a sign that in the US GDP expansion may not have been as broadly spread as politicians might have hoped and concentrated in one or two areas such as technology. When annuities are included, there is a stronger correlation to GDP, albeit that this may well not represent a sustainable trend as old defined benefit schemes are replaced with “cheaper” retirement provision.

It is tempting to think that were the US economy to fall into some form of recession, the chart lines might become more realigned, but the fear is that such economic contraction – or at least, economic pausing – would induce a further wave of policy cancellations and surrenders as we witnessed in 2023.

Solvency

The health of insurers is of vital importance to both secondary market investors as well as giving confidence to individuals wanting to buy new policies for protection – and needing their insurer to be there when the fateful moment arrives.

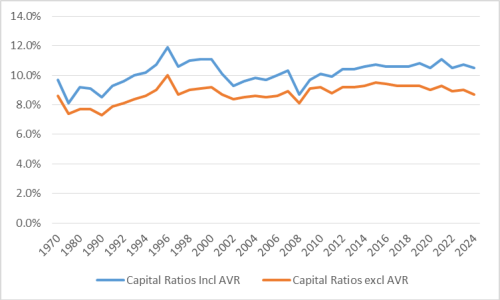

Here, the ACLI Life Insurers Fact Books provide a historic record of aggregate solvency levels for the industry. Solvency can be measured in numerous ways, with different measures of surplus capital and different benchmarks to compare against. The simplest are insurers’ capital ratios. The Asset Valuation Reserve (AVR) – which smooths against temporarily depressed or over-cooked market values of assets either being included or excluded – is an insurer’s own capital and surplus and divided by their general account reserves.

Figure 4: Broad Capital Ratios 1970 – 2024

Source: ACLI Life Insurers Fact Book, 2025 Edition

Figure 4 shows a mixed picture of continuing financial health but also a decline in the broad capital ratios in 2024. Notably, after a period of improving headline ratios (including the AVR as part of the available capital during the period whilst QE was holding interest rates down) the ratio excluding the AVR has now dipped to its lowest value since 2008.

A growing AVR can arise from strong equity markets offsetting weak bond markets, but a crash in equity markets might not precipitate weaker capital ratios if bond prices were to rise consequently. In 2025 we saw further growth in equity markets and only a limited rise in bond markets so it will be interesting to see if the AVR widens next year. Overall, though, these weakening ratios don’t appear to be out of the long-term range.

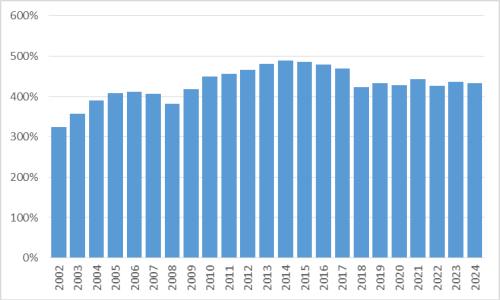

A real sign of any stress emerging is to look at the Risk Based Capital Ratios, which measure the amount of headroom over the regulatory minimum required capital before insurers must start implementing a program for restoration.

Figure 5: RBC ratios 2002-2024

Source: ACLI Life Insurers Fact Book, 2025 Edition

Figure 6 below shows the ratio of available capital to the minimum capital required and whilst the 2024 average ratio of 434% is below that observed in 2023, it is in the middle of the range of values since 2017; this does not indicate an industry with problems immediately emerging.

The shortcoming of using averages is that they hide spread. However, the ACLI does provide a distribution of insurers’ RBC ratios.

Figure 6: Percentage of Companies whose RBC Ratio Exceeds 200% 2013-2024

Source: ACLI Life Insurers Fact Book, 2025 Edition

As with all the various measures of solvency in 2024, there is a marginal downtick but nothing that looks to be outside the normal year-on-year noise.

The number of companies below 200% is 36 (2023: 32) and, as can be seen by the much smaller percentage below 200% measured by assets, the weaker companies are generally the much smaller institutions. Of that 36, there are 8 falling below 100%. This does not make them insolvent, but financially fragile, however they are likely to be special companies with unusual characteristics and therefore unlikely to be of much concern to secondary market investors.

As was the case last year, the overall message here is one of consistency. US life insurer ownership and business composition trends remain at similar levels to recent years, albeit with small, but observable, trends. And solvency metrics appear to be solid. All in all, as counterparties for longevity and mortality risk investors, US life insurers remain strong.

Roger Lawrence is Managing Director at W L Consulting

Footnotes

- ACLI Life Insurers Fact Book, Page 3, Table 1.1

- ACLI Life Insurers Fact Book, Page 7, Table 1.7

- ACLI Life Insurers Fact Book, Page 6, Table 1.6

Any views expressed in this article are those of the author(s) and may not necessarily represent those of Longevity & Mortality Investor or its publisher, the European Life Settlement Association