Over the last two centuries, average lifespans have doubled. For pension schemes, insurers and policymakers, this long-term trend has shaped how we think about retirement, ageing and financial security.

But the story is becoming more complex. Recent decades have seen a slowdown in improvements. Covid-19 caused widespread disruption, and continuing healthcare pressures mean the future is less predictable. In this blog, we reflect on what’s happening to longevity – and what it means for pensions and insurance.

The impact of the Covid-19 pandemic

Through the 1990s and 2000s, as rates of mortality fell, life expectancy rose rapidly. From around 2010, rates began to level off. However, the picture differed by age group:

Pensioners continued to see steady year-on-year falls in rates of mortality.

Working-age adults over 45 experienced little change.

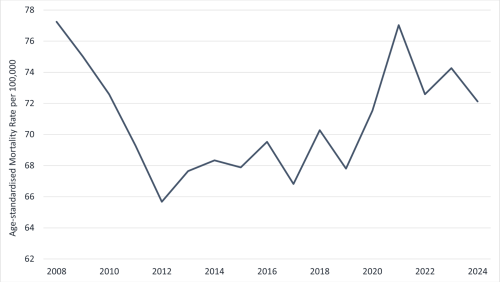

Younger adults under 45 saw rising mortality rates (Figure 1).

Figure 1: Under 45s Mortality Rate (Ages 15–44) – England and Wales

Source: CMI Mortality Monitor

The stagnation of life expectancies, and particularly the increasing mortality rates for younger ages, are unusual by historical standards. This raised questions even before the pandemic struck. The pandemic was an unprecedented mortality event. In the UK alone, around 70,000 excess deaths [1] were recorded in 2020 alone, mostly among older people. Mortality rates spiked dramatically, before gradually falling back. By 2024, overall mortality rates were back to 2019 levels, but no lower. That means five years of “lost progress” in life expectancy.

For younger and working-age adults, the impact looked different. Excess deaths peaked later, in 2021, and not all of them were linked to Covid-19 itself. The remainder reflect wider system pressures – from overloaded hospitals to delayed diagnoses and treatments.

Pressures on healthcare are driving mortality outcomes

One of the clearest insights from recent years is the role of healthcare system performance in shaping longevity. Waiting times for urgent and chronic care remain a serious concern.

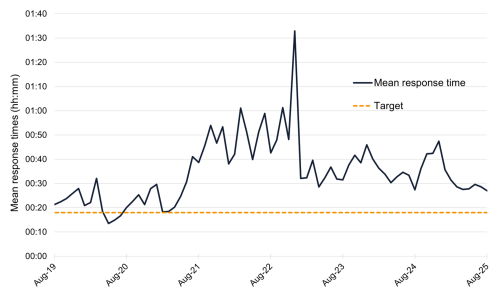

Ambulance response times for conditions such as heart attacks and strokes (category 2 emergencies) rose from broadly meeting their 18-minute target pre-pandemic to over 90 minutes at the worst point. Even now they average 30-40 minutes – double the target.

Figure 2: Category 2 Ambulance Response Times (England)

Source: NHS England

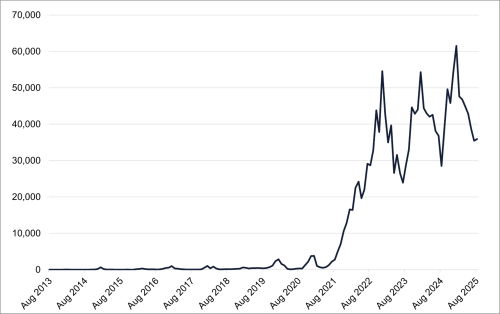

A&E waits for hospital admission after a decision to admit peaked at 60,000 people per month waiting over 12 hours (Figure 1), compared to peaks of fewer than 1,000 pre-pandemic. The target, of course, is zero.

Figure 3: Number of A&E Patients Waiting More Than 12 Hours From Decision to Admission (England)

Source: NHS England

Cancer treatment delays mean only 7 in 10 patients now begin treatment within 62 days of referral, well below the NHS’s 85% target.

Each of these failures has a measurable impact on survival. Research suggested that longer A&E waits alone contributed to over 400 additional deaths per week over the 2022/23 winter period.

What does this mean for actuarial forecasts?

For pension schemes, insurers and reinsurers, the question is how these trends affect life expectancy forecasts. Mortality models have had to adapt quickly.

The Continuous Mortality Investigation (CMI) recently made the biggest overhaul to its projection model in a decade, explicitly recognising the shock of Covid-19 and differences in trends by age. For example, a 65-year-old male pensioner is now expected to live around 22 years – roughly three months longer than under the previous model version, thanks to refinements in how age-specific improvements are treated.

At LCP, we welcome these changes, but we continue to also apply our own adjustments. In particular, we are cautious about the model’s relatively optimistic assumptions for old-age improvements over the short-term. Our medical colleagues suggest large future gains in older-age survival are unlikely given current health system pressures.

Blending actuarial models with medical insight

One of the advantages we have at LCP is the ability to combine actuarial modelling with direct input from doctors, epidemiologists and public health experts. Each year we bring together a panel of medical specialists from our Health Analytics department to form structured, consensus views on likely trends in mortality. For example, we are currently considering how cancer, cardiovascular disease and other major causes of death will progress in the coming years.

These insights help us to refine actuarial models, especially over the short to medium-term. The result is a grounded view of longevity risk, rooted both in statistical history and clinical reality. Small technical changes can shift liabilities by around 0.5% – material for many pension schemes and insurers.

Short-term headwinds vs long-term optimism

Looking ahead, we are cautious about projecting significant improvements in life expectancy over the next decade. The challenges are clear: NHS capacity pressures, an aging population, rising chronic disease, and socioeconomic inequalities in health outcomes.

But longer-term, we remain optimistic. There are powerful drivers of future gains, from medical innovation to lifestyle change. Promising areas include new treatments, such anti-obesity drugs; improved cancer diagnostics; and behavioural and societal shifts, including reduced smoking and cleaner air.

We also know from international comparisons that life expectancy in the UK still lags behind peers like Japan, Sweden and Australia, suggesting there is plenty of headroom for improvement.

What this means for pensions and insurers

For trustees, sponsors and insurers, longevity risk remains highly uncertain in the near term, with muted improvements likely over the next decade. Mortality modelling must reflect healthcare realities, not just long-run statistical trends, as even small changes in assumptions can have material impacts on liabilities and pricing. In our view, optimism over the long-term remains justified.

The success story of rising life expectancy is far from over, but it is evolving. For pensions and insurance, the challenge is to reflect short-term headwinds without losing sight of long-term potential. By combining actuarial models with medical insights, we can form a robust view of the future and help schemes and insurers make better decisions today.

Stuart McDonald is a Partner and Head of Longevity and Demographic Insights at Lane Clark & Peacock

Chris Tavener is a Partner and Head of Life Analytics at Lane Clark & Peacock

Ben Rees is a Partner at Lane Clark & Peacock

Footnotes:

- In this context, excess deaths are deaths over and above what we would have expected in the absence of the pandemic.

Any views expressed in this article are those of the author(s) and may not necessarily represent those of Life Risk News or its publisher, the European Life Settlement Association