ESG has moved forward in the financial markets dramatically in the last few years. ILS and (re)insurance are a part of this ESG movement, thus providing many opportunities for our industry.

Every industry views ESG through its own lens but what does ESG mean to the (re)insurance industry?

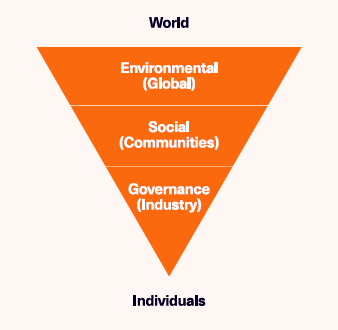

- Environmental – For example, Climate Change, Natural Resources, Pollution & Waste, Low Carbon Transition, Risk Protection Gap

- Social – For example, Human Capital, Product Liability, Stakeholder Opposition, Social Opportunities, Financial resilience for all, Human Rights

- Governance – For example, Corporate Governance, Corporate Behaviour, Anti-corruption, Anti-bribery.

It is important to look at all 3 areas individually, but we also believe that it is important to look at them as an interlinked process. One way we view the components, and their scale of influence, are as a “cone.” From global to local impact and the effects on corporations and individuals, all three parts are linked, and it is important that we have a balanced view across them.

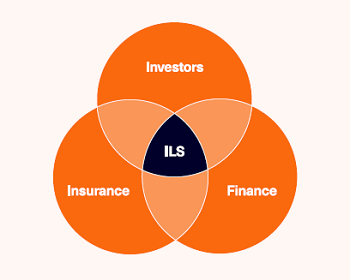

The ILS industry is in a unique position as it is at the crossroads between many financial sectors. The strategy is based in (re)insurance, but has investors from other sectors, as well as dealing with the banking arena. One other uniqueness is that ILS in the EU will be regulated for ESG before other financial products, like (re)insurance, which sets some challenges, but also creates opportunities.

The EU’s Sustainable Financial Disclosure Regulation (“SFDR”) came into effect on the 10th of March 2021, as part of the EU’s efforts to ensure financial firms such as fund managers, insurers, and banks that provide financial products and services within the region are comprehensively disclosing just how committed to sustainability they truly are. The SFDR defines a three-tier classification for financial products based on several aspects of both the product and its investment process. This classification comes with differing and increasing levels of disclosure requirements.

Article 6 – financial products which do not integrate sustainability into the investment process, with disclosure requiring an explanation of sustainable risk integration into investment decision-making;

Article 8 – financial products promoting environmental and/or social characteristics, with disclosure requiring information on how those characteristics are met;

Article 9 – financial products with a targeted sustainability objective, with disclosure requiring information on how the sustainable investment objective will be attained.

The new SFDR regime provides a framework in the EU for investment managers to be able to classify their funds as promoting environmental and social characteristics, rather than having a passive approach or disregarding them. Below is how we look at ESG based on these categories.

Life

In terms of ESG, insurers score highly on social impact. Although, not often perceived as social impact investments, insurers have as their core modus operandi that they provide financial stability to families in times of need, be that due to the impact of natural catastrophes or matters related to health and mortality.

Across the globe, the Covid-19 pandemic and the risks associated with it have highlighted to individuals the need to be better prepared in case of contracting a debilitating disease or death. Closing the protection gap has the potential to be a powerful business plan for newer entrants, and Life ILS plays a critical role in supporting the expansion of coverage through new and existing enterprises.

The US in particular has undergone significant changes to the accessibility of health insurance through the implementation of 2009’s Affordable Care Act and many investment opportunities abound for ILS investors to support the broadening of the penetration of health insurance in the US. For the elderly, the baby boom generation has created a tidal wave of demand for medicare options, providing ILS investors the opportunity to support greater health insurance accessibility for both working age Americans and retirees.

Such examples of social impact investing are material in the US, but in Europe the main investment opportunities are found in the support of the transition from corporate pensions to private, savings-oriented insurance. Although less focused on accessibility, investment opportunities in Europe facilitate the successful provision of financial planning options to provide greater security to retiring Europeans.

Focusing on “E”, life and health insurers are not unexposed to climate change, but these issues typically arise from their investments. In many cases, insurers have begun offering ESG-oriented funds and impact investment options through their savings products, particularly in the UK and Europe. Many ILS investments that support the growth of such policies are therefore also supportive of ESG principals. However, in general, life and health insurers typically have limited direct weather risk or impact to their business models, being based in electronic financial contracts and a largely developed country workforce.

Non-Life

When it comes to natural catastrophes, non-life insurance is vital for reducing the protection gap. This is the difference between the total economic cost of a natural disasters and the support provided by the (re)insurance industry through claims payments. Insurers provide vital financial support that helps communities recover and rebuild after such events.

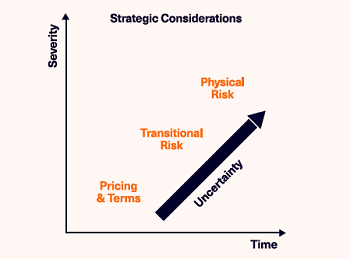

Non-life insurance is perhaps more sensitive to the “E” component of ESG, as an element of the protection offered generally relates to climate perils like windstorms, floods, drought, and other meteorological perils. This can be viewed through two lenses. Firstly, for insurers and ILS it is necessary to understand the current and future quantum of risk, so that risk can be appropriately priced, and portfolios managed effectively. But more importantly, climate change will likely change the frequency and/or severity of natural hazards experienced by communities around the globe, and insurance represents a vital source of financial support to aid recovery after such events.

A simplistic summary of the way we think about climate change at Leadenhall is:

Risk AND opportunity:

- It is vital to understand the changing natural and financial ‘climates’

- This is required to inform a flexible and evolving strategy, so that we can adapt to the changing ‘climates’ and take advantage of the opportunities that arise from those changes

Natural hazard changes:

- Significant uncertainty exists depending on the hazard considered; potential changes in temperature (e.g., drought) are better understood than extreme weather (e.g., windstorms)

- The timescales of change are also important to define a complete forward-looking strategy, (i.e., current vs. medium-term vs. long-term)

Financial changes:

- Some classes of insurance may become unsustainable without adjustment in premium and/or risk evaluation

- New classes of insurance or products may become available providing further investment opportunities

With the above in mind, climate change should be viewed as a risk that needs to be managed and understood, but also an opportunity to expand on the protection offered to the community through greater insurance penetration, particularly in developing economies. Insurers can also endeavour to influence larger environmental shifts, by supporting greener technologies and industries through the provision of insurance solutions and allocations within their own investment portfolios.

Not Just E

Besides such external social impacts of insurance, the investments themselves should be viewed for their internal social impacts alongside their governance frameworks. Most insurance enterprises support diverse workforces similar to the communities they serve, and human resource departments typically are very aligned with the most current best practices given the businesses are related to social benefits.

From a governance perspective, entities in the insurance value chain are typically regulated by at least one or more regulators providing a high degree of both behavioural and fiscal oversight. Given many of the ILS investments are in smaller entities, sometimes these private businesses may lack independence in the majority of Board seats. Such a detriment is, however, offset by typically direct representation of the major owners on such boards.

More broadly, comfort can be taken from the fact that many insurers are signatories to the UNPRI or utilise asset managers who are. There are geographical differences in attention levels applied to climate change issues in their investments, with Europe and the UK insurers leading. This is in part driven by the local regulators who have begun greater disclosures and risk assessments of global warming and sea level rise on insurers investment portfolios. Many European insurers have begun to provide emissions tracking of activities and CO2 footprint analysis. Outside of Europe, there is limited environmental impact or risk disclosures.

Covid-19

The Covid-19 pandemic has very much focused people’s minds on ESG. Most insurers have adopted climate friendly business processes, particularly during the current pandemic, including efforts to reduce business travel, broaden work from home policies and promote virtual sales processes.

In terms of interest in ILS investments, Leadenhall has observed an increase of inquiries from investors over the past year. The pandemic has been like a rapid climate change. The numbers of fatalities have been so stark to the extent a government or industry alone cannot hope to solve the pandemic – it has to be a worldwide effort.

The same is the case with climate change. The pandemic has highlighted the need to work together to solve climate change. Industry will need to collaborate with communities and governments across the globe with ESG. While not always “impact” investments, insurance ILS can be aligned very comfortably within an ESG framework as a notable promotor of these essential standards, promoting initiatives to create new ‘green’ products to enhance the positive impact the industry has worldwide.

Phil Kane is Partner, Portfolio Management and Senior Credit Officer at Leadenhall Capital Partners

Adrian Mark is Partner, Head of Non-Life Analytics at Leadenhall Capital Partners

Jillian Williams is Partner, CUO and Head of ESG at Leadenhall Capital Partners

Any views expressed in this article are those of the author(s) and do not necessarily reflect the views of Life Risk News or its publisher, the European Life Settlement Association